Analyzing benefit quotes is one of the most time-consuming yet critical tasks in a broker's workflow. A thorough quote analysis can uncover significant savings for clients and differentiate your services from competitors. This guide covers the systematic approach used by top-performing brokers to analyze quotes efficiently and accurately.

Why Systematic Quote Analysis Matters

Average savings found when comparing 5+ carriers

Time saved per case with structured analysis process

Close rate improvement with data-driven recommendations

The 6-Step Quote Analysis Process

Gather All Carrier Quotes

Collect quotes from multiple carriers in their original formats - PDFs, spreadsheets, or online portals.

- Request quotes from at least 3-5 carriers for competitive analysis

- Ensure all quotes use the same census data

- Note effective dates and rate guarantee periods

Normalize the Data

Convert all quotes to a consistent format for accurate comparison across carriers.

- Standardize tier structures (EE, EE+SP, EE+CH, FAM)

- Convert all rates to monthly premiums

- Account for different contribution methodologies

Compare Plan Designs

Analyze benefit levels beyond just premium costs to understand true value.

- Compare deductibles, out-of-pocket maximums, and copays

- Review network size and provider access

- Evaluate prescription drug coverage tiers

Calculate Total Employer Cost

Model different contribution scenarios to understand full financial impact.

- Factor in current enrollment distribution by tier

- Model employer vs employee cost splits

- Include ancillary benefits in total package cost

Identify Renewal vs New Business Rates

Understand rate changes and potential savings opportunities.

- Calculate year-over-year rate changes

- Highlight potential savings from carrier switching

- Note any first-year discounts or promotions

Build Your Recommendation

Synthesize analysis into clear, actionable recommendations for your client.

- Lead with 2-3 top recommendations

- Quantify savings in dollars and percentages

- Address plan design trade-offs clearly

Key Metrics to Track in Every Analysis

Premium Spread

Range between lowest and highest carrier quotes

Renewal vs Market

Current rates compared to competitive quotes

Plan Value Index

Premium cost relative to benefit richness

Employee Cost Impact

Per-paycheck change under each scenario

Employer Cost Change

Total annual cost difference from current

Common Quote Analysis Mistakes (And How to Avoid Them)

Comparing rates without normalizing tier structures

Ignoring network differences

Focusing only on premium costs

Not modeling employee impact

Presenting too many options

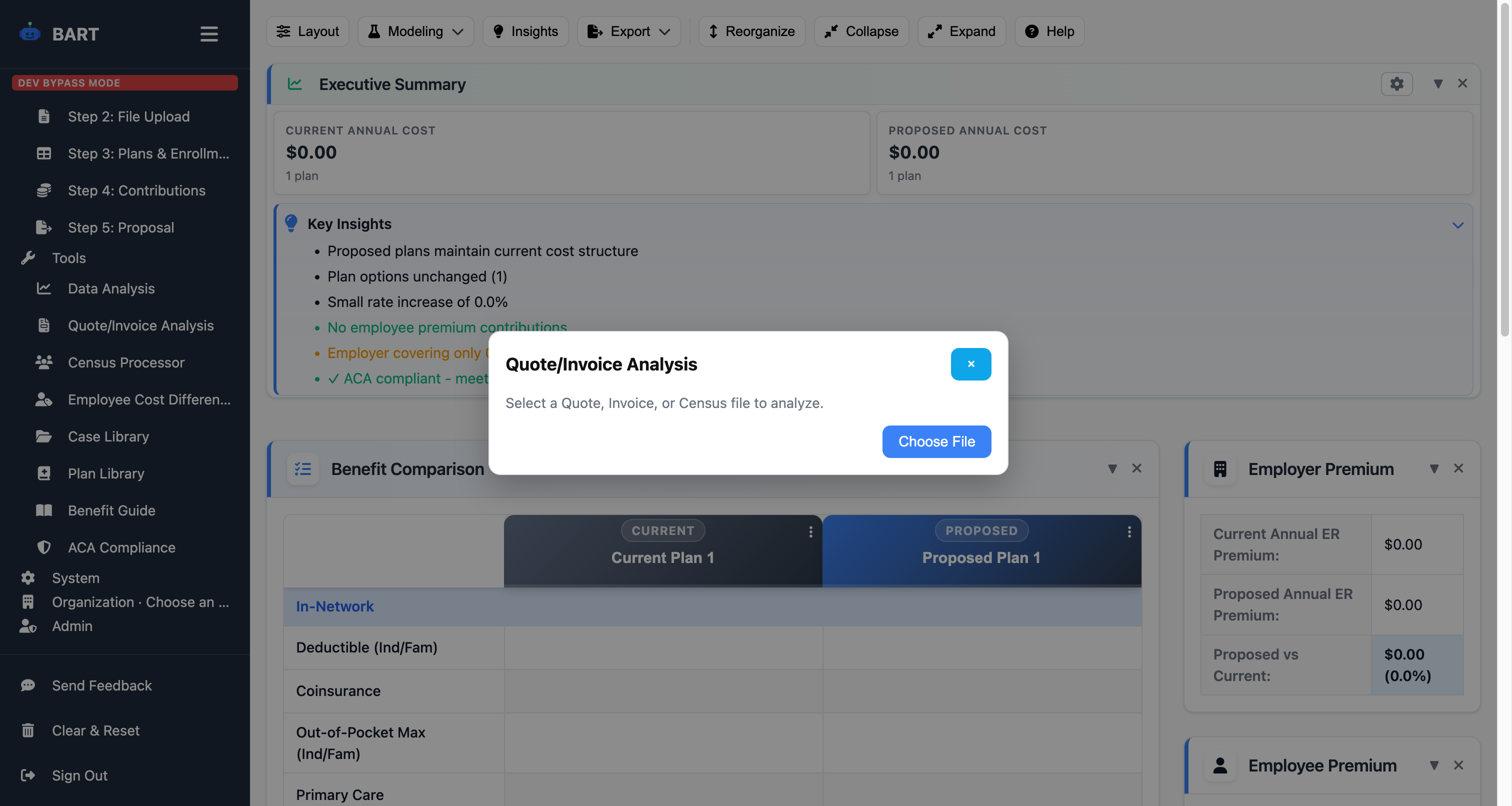

Tools That Streamline Quote Analysis

While spreadsheets have been the traditional tool for quote analysis, modern benefit administration platforms offer significant advantages:

Automated Data Extraction

AI-powered tools can extract rate data directly from carrier PDFs, eliminating manual data entry errors and saving hours per case.

Real-Time Contribution Modeling

Instantly see how different contribution strategies affect employer and employee costs across all quoted plans.

Side-by-Side Comparisons

Generate professional comparison charts that highlight key differences in plan design and costs.

Client-Ready Reports

Export analysis directly to branded proposals without recreating work in separate presentation tools.

Quote Analysis Best Practices Checklist

Streamline Your Quote Analysis Workflow

BART automates the tedious parts of quote analysis so you can focus on strategy and client relationships. Upload carrier quotes and get normalized comparisons in minutes, not hours.