Step 1: Type

Choose the benefit type to tailor the workflow and validations.

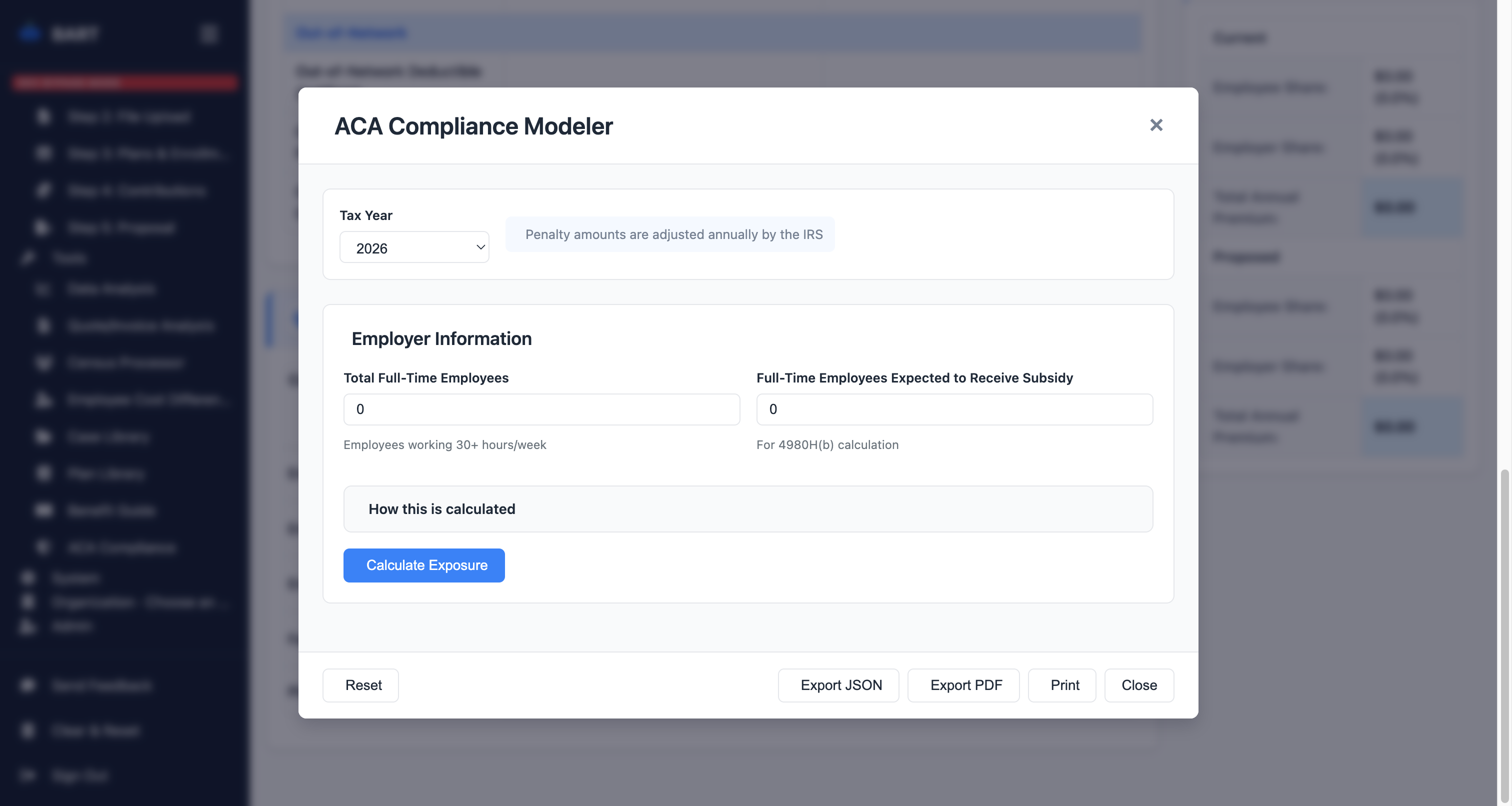

Built-in affordability calculator ensures your benefit recommendations meet IRS requirements and helps clients avoid costly penalties.

Automatically calculate if plans meet ACA affordability requirements based on current IRS thresholds.

See potential 4980H(b) penalty exposure if plans don't meet affordability requirements.

Penalty amounts are automatically adjusted annually based on IRS guidelines.

Track total full-time employees and those expected to receive subsidies for accurate calculations.

Export compliance analysis as PDF or JSON for client records and documentation.

Get instant feedback on whether contribution strategies meet affordability thresholds.

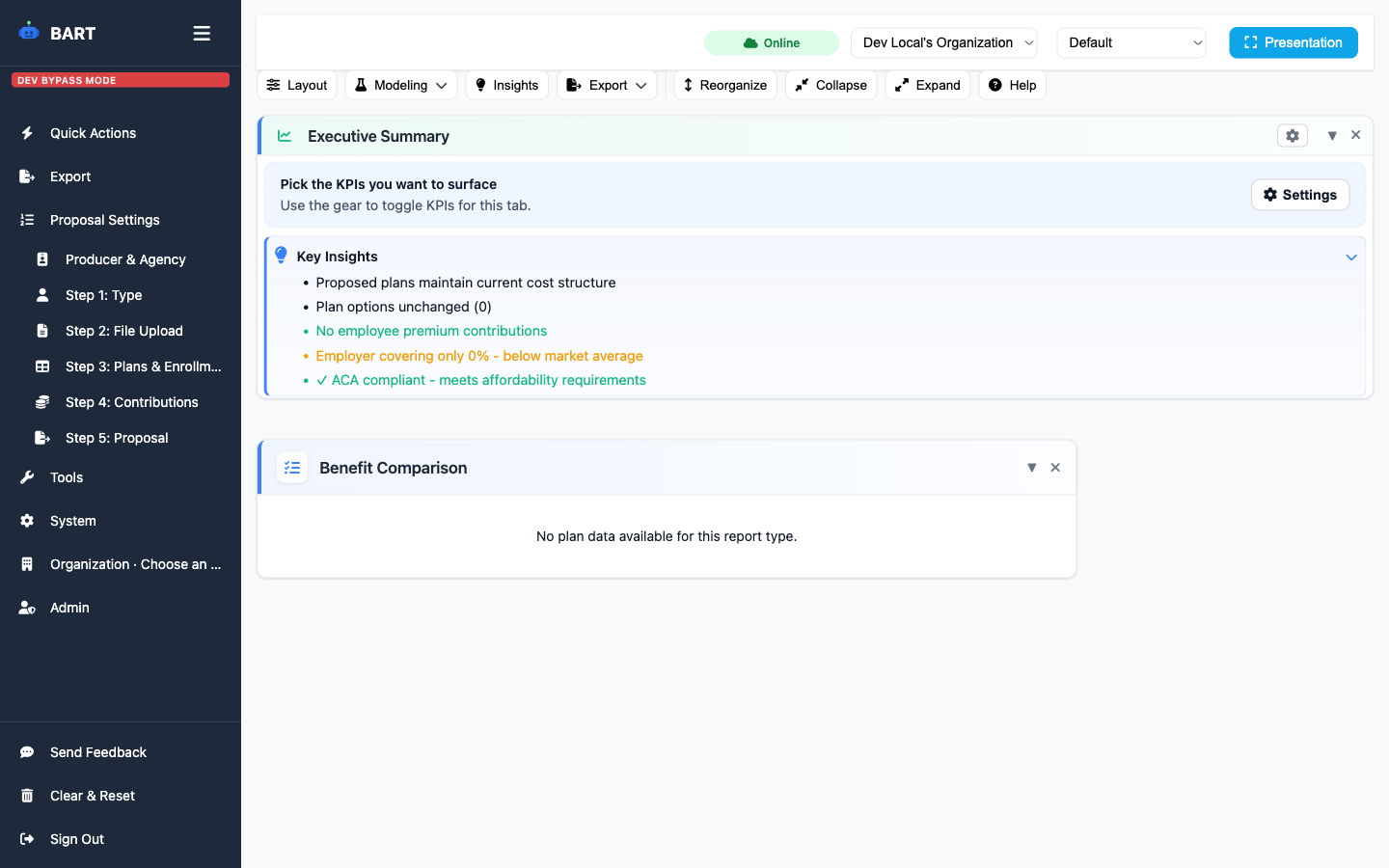

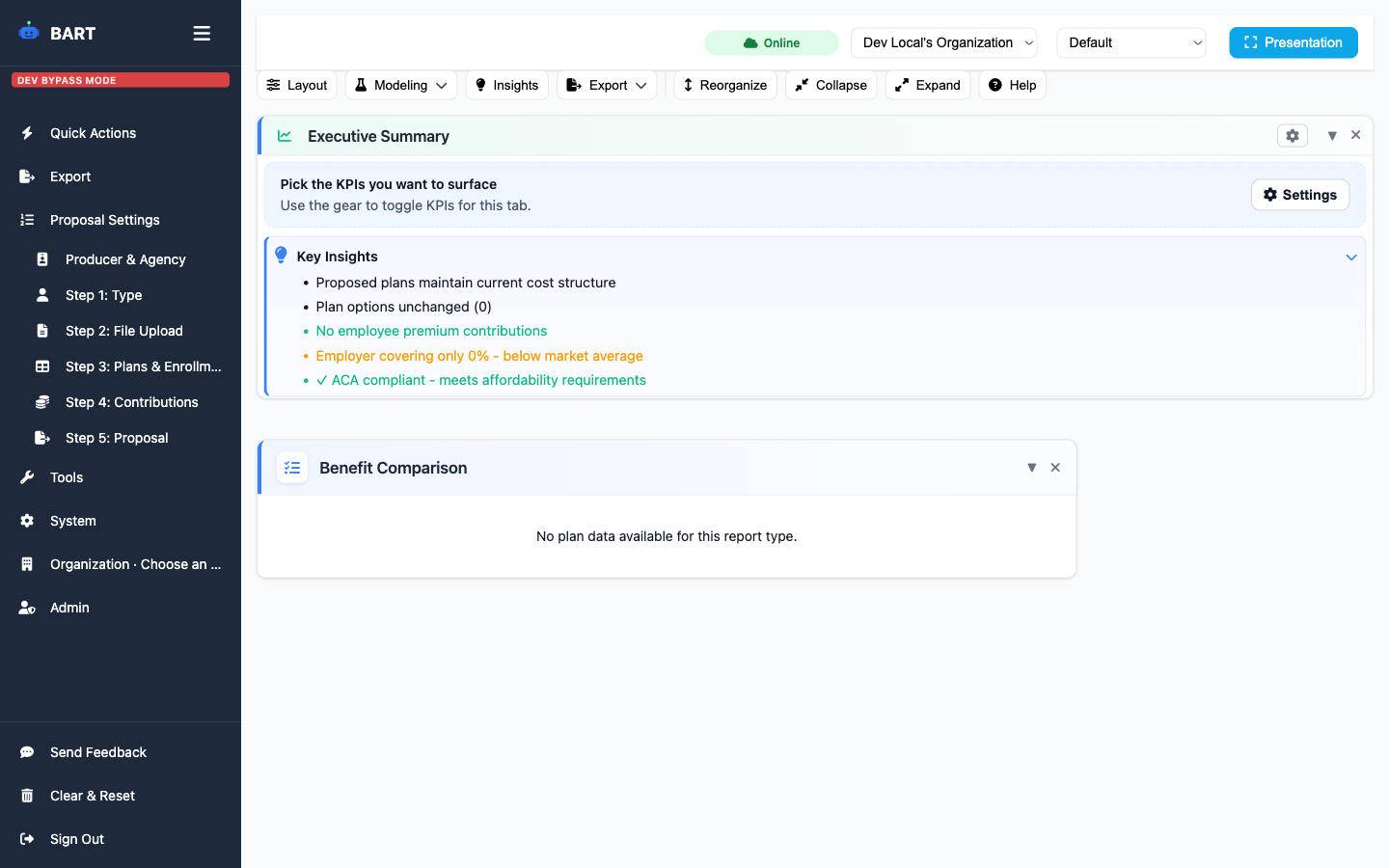

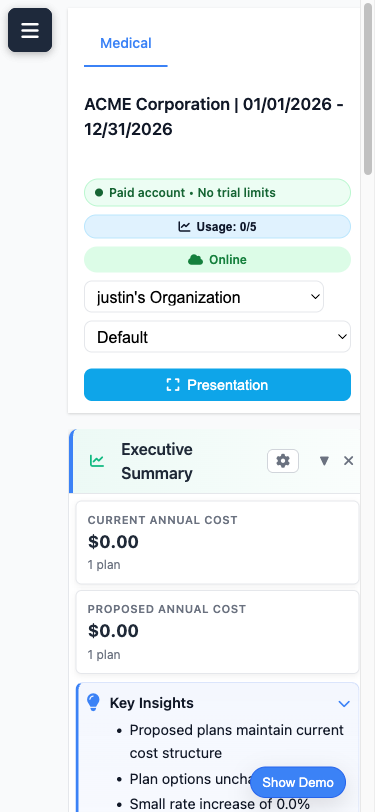

Mirror the 5-step wizard from intake to proposal.

Choose the benefit type to tailor the workflow and validations.

Import carrier files or census data to pre-fill plan details.

Map enrollments and rates, or copy from current plans.

Set employer and employee contributions and preview impact.

Generate the proposal and jump into presentation mode.

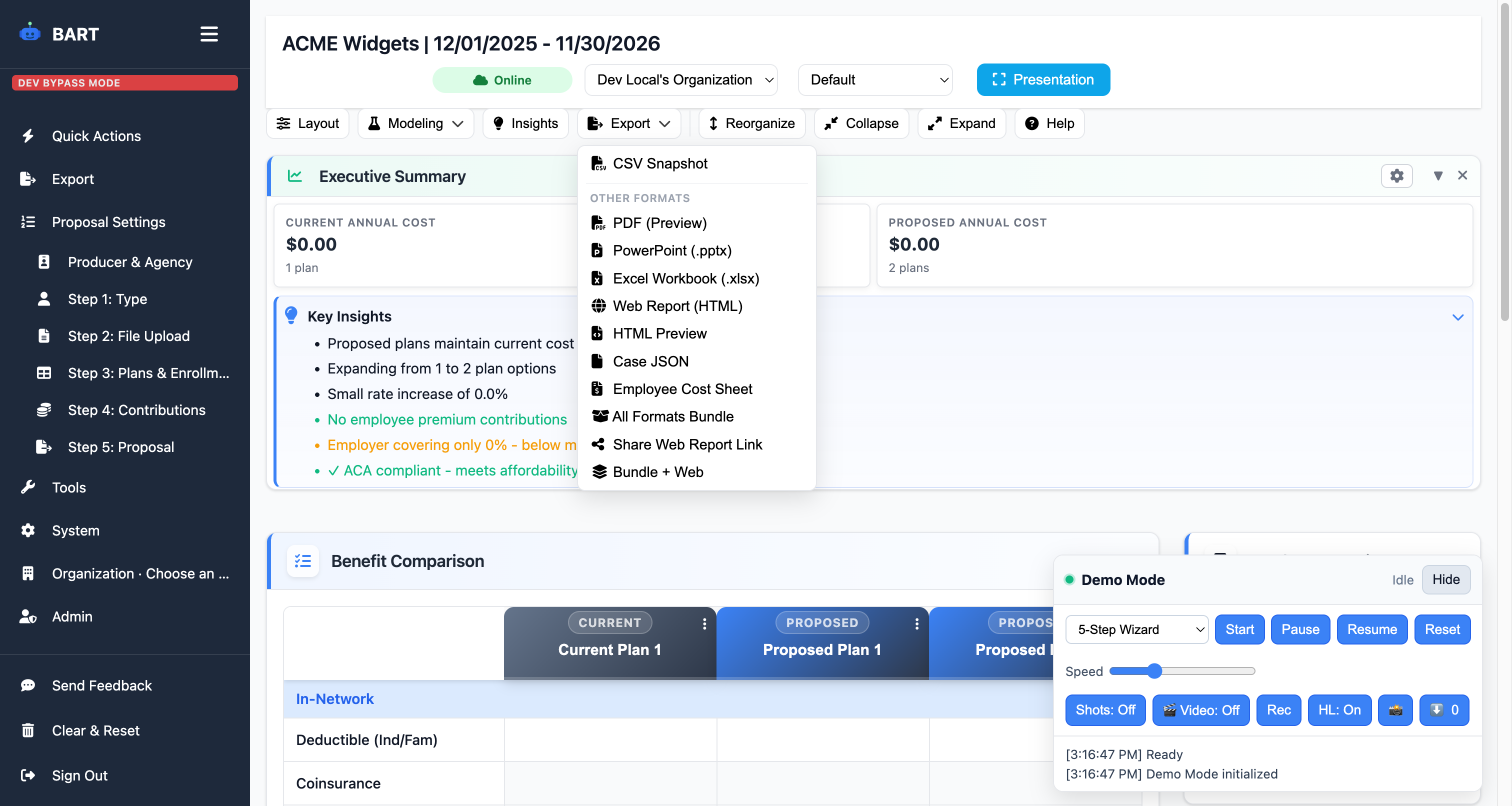

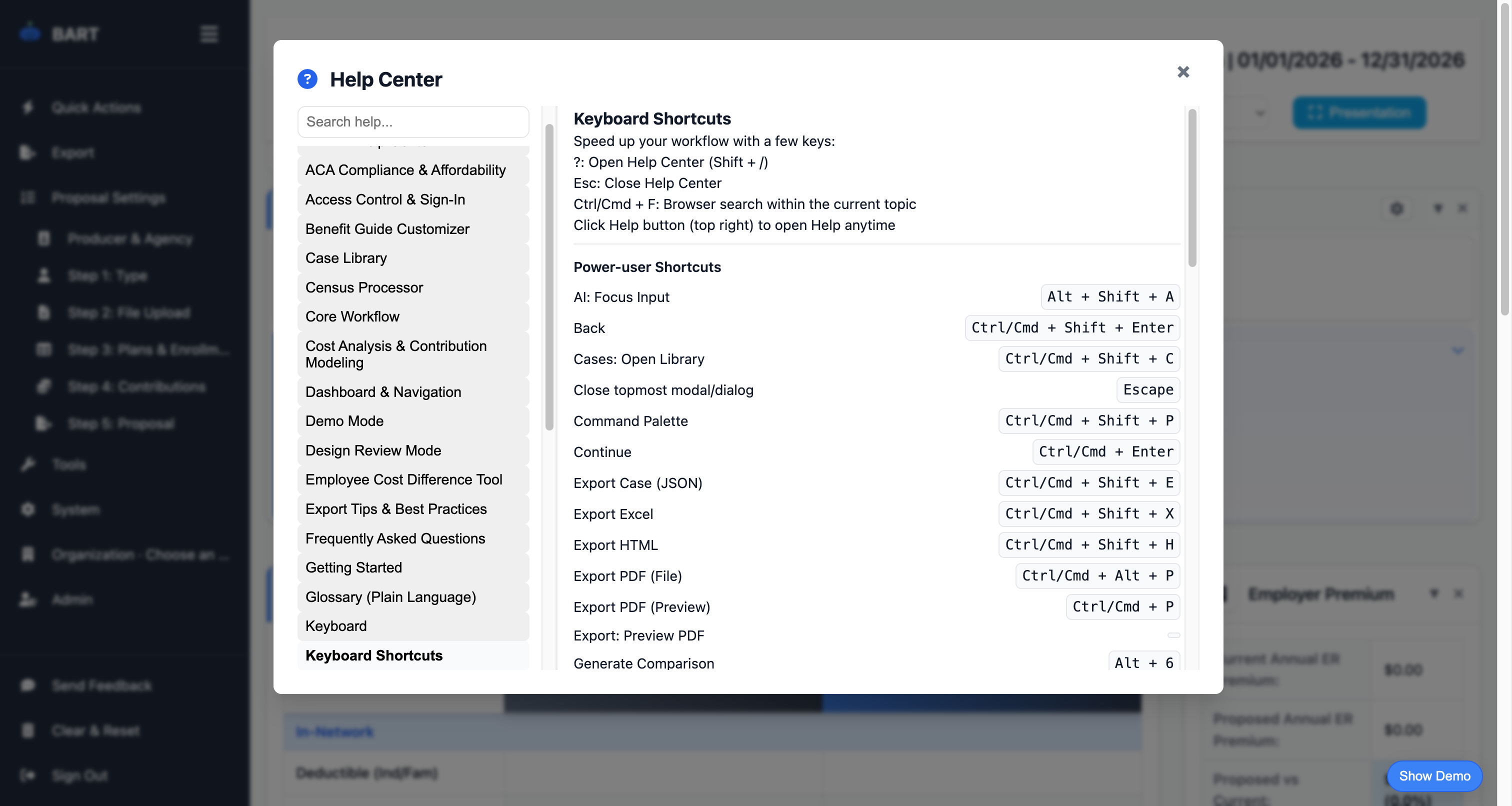

Jump between cases, uploads, and exports without breaking focus.

Stay in flow with command palette, export, and navigation shortcuts.

Send dashboards, PDFs, or spreadsheets straight from the toolbar.

Inline help center keeps guidance one click away.

Parsing, validation, and quality signals keep uploads reliable.

Smart Parsing

API parser for PDFs and docs with automatic structure detection.

CSV Fallback

Built-in CSV/TXT reader when external services are unnecessary.

Quality Signals

Header verification and confidence flags to catch issues early.

Coverage Check

Geography coverage status before committing exports.

Responsive layouts keep executive summaries, quick actions, and exports usable on the go.

Start your free proposal today and see the difference.

✓ No credit card required • ✓ Free during beta • ✓ Cancel anytime